itimas.online Learn

Learn

Best Performing Wealth Managers

1. VMT Wealth Management VMT Wealth Management, a name synonymous with financial growth and asset management, epitomizes the essence of a sound wealth. Ultra-High Net Worth Wealth Management Firms · 1. Group · 2. Jones Zafari Group · 3. The Polk Wealth Management Group · 4. Hollenbaugh Rukeyser Safro &. Top 10 Wealth Management Teams High Net Worth ; 6. Ellison Kibler & Associate. Merrill Private Wealth Management ; 7. Clarity Wealth. Wells Fargo Advisors ; 8. The. Call Sparrow Wealth Management in Lake Nona, FL to speak with a fee-only financial advisor During the first quarter of , the best performing asset classes. Best-Performing Asset Classes. According to Yale University's Crash Confidence Index, only about 40% of investors are confident the stock market will not. Top Dallas Wealth Manager. D Magazine. #2 Largest Wealth Management Firm. Dallas Business Journal. Best-Performing Small Bank. Tolleson Private Bank S&P Global. Congratulations to the 42 Morgan Stanley Financial Advisors named to this year's Barron's Top Financial Advisors ranking—more than any other firm. By. Linden Thomas & Company, one of the nation's top private wealth manager with 30 national recognitions, has put the client first for 30 years. The top investment & wealth management companies to pay attention to in · Powerful data and analysis on nearly every digital topic · Want more. research? 1. VMT Wealth Management VMT Wealth Management, a name synonymous with financial growth and asset management, epitomizes the essence of a sound wealth. Ultra-High Net Worth Wealth Management Firms · 1. Group · 2. Jones Zafari Group · 3. The Polk Wealth Management Group · 4. Hollenbaugh Rukeyser Safro &. Top 10 Wealth Management Teams High Net Worth ; 6. Ellison Kibler & Associate. Merrill Private Wealth Management ; 7. Clarity Wealth. Wells Fargo Advisors ; 8. The. Call Sparrow Wealth Management in Lake Nona, FL to speak with a fee-only financial advisor During the first quarter of , the best performing asset classes. Best-Performing Asset Classes. According to Yale University's Crash Confidence Index, only about 40% of investors are confident the stock market will not. Top Dallas Wealth Manager. D Magazine. #2 Largest Wealth Management Firm. Dallas Business Journal. Best-Performing Small Bank. Tolleson Private Bank S&P Global. Congratulations to the 42 Morgan Stanley Financial Advisors named to this year's Barron's Top Financial Advisors ranking—more than any other firm. By. Linden Thomas & Company, one of the nation's top private wealth manager with 30 national recognitions, has put the client first for 30 years. The top investment & wealth management companies to pay attention to in · Powerful data and analysis on nearly every digital topic · Want more. research?

Financial Synergies Asset Management Inc. itimas.online Houston, TX $ million. $ BlackRock · · 24, ; State Street Global Advisors · · ; Allianz Life · · 4, ; Investors Management Corporation · · 21 ; BNY Mellon · 52, results for Wealth Management · itimas.onlineziz AlHamad · Layla Issa Abuzaid · Aankit Ajmera · Nivedhitha Gurunathan · Edouard Colson · Sign in to view more. America's Top Wealth Management Teams. • ; Top Women Wealth Advisors. • • • • ; Top Wealth Advisors Best-In State. •. BlackRock. BlackRock is a global investment management firm that offers a range of financial and investment services to individuals, institutions, and. Congratulations to these Forbes-recognized financial advisors One of our financial advisors ranked among the top across America: Troy Nelson (rank No. Top 30 Wealth Management Firms · 1. UBS Wealth Management · 2. Credit Suisse* · 3. Morgan Stanley Wealth Management · 4. Bank of America GWIM. best meet your needs, ambitions ScotiaMcLeod Investment Portfolios – Asset management is performed on a discretionary basis by Asset Management L. Below is this year's list of the top rated financial advisors, wealth management firms, and financial planners who serve clients in communities in and around. Ranked 9th Top Wealth Managers By Growth in Assets in the U.S. from RIA Channel, RIA Database and RIA Channel are registered trademarks owned by Labworks. Wealth management companies offer a range of services such as investment planning, portfolio management, retirement planning, tax planning, estate planning. Personal Capital vs Kubera: The Best Wealth Management Tool for Canada Staying on top of your monetary situation is important, but it's hard to trust a third-. This behavior opposes the basic tenet of investing – buy low and sell high – and can cut dramatically into investor wealth. In addition, past performance is. Top 30 Wealth Management Firms · 1. UBS Wealth Management · 2. Credit Suisse* · 3. Morgan Stanley Wealth Management · 4. Bank of America GWIM. Forbes “America's Top Next-Gen Wealth Advisors” list. Published on August 8, Rankings based on data as of March 31, 1. BlackRock, $10,,,,, Asset Manager · 2. Vanguard, $8,,,,, Asset Manager · 3. Fidelity Management & Research, $3,,,, · 4. The. The top investment & wealth management companies to pay attention to in · Powerful data and analysis on nearly every digital topic · Want more. research? Overview of Advisory Firm Reviews in the United States ; Fisher Investments Fisher Investments logo · $,,,, 1, ; Merrill Lynch Wealth Management. Top financial advisor firms. Vanguard; Charles Schwab; Fidelity Investments; Facet; J.P. Morgan Private Client Advisor; Edward Jones. Top 10 Best Wealth Management Near Honolulu, Hawaii · 1. Kala Capital. (20 reviews) · 2. Agape Wealth Management, LLC. (19 reviews) · 3. E.A. Buck.

How Much Does Mortgage Cost

Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. Total Home Ownership Cost The total cost of home ownership is more than just mortgage payments. Additional monthly costs include homeowner's insurance. Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use. How do mortgage interest rates work? When you take out a mortgage loan, the lender charges you interest on the amount you borrow. This interest is a. Common mortgage refinance fees ; Origination fee, Up to % of loan amount ; Credit report fee, $10 to $ per applicant ; Document preparation fee, $50 to $ payment be? Tell us about what mortgage you're looking for and we'll estimate how much your monthly payments will be. Step 1. What are you looking to do? Calculate what your mortgage payment could be. Find out how changing your payment frequency and making prepayments can save you money. How much of a down payment do you need? To get the best mortgage interest rates and terms, you'll want a down payment amounting to 20% of a home's sale price. Our Mortgage payment calculator can help determine your monthly payment and options to save more on mortgages. Visit Scotiabank online tool today! Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. Total Home Ownership Cost The total cost of home ownership is more than just mortgage payments. Additional monthly costs include homeowner's insurance. Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use. How do mortgage interest rates work? When you take out a mortgage loan, the lender charges you interest on the amount you borrow. This interest is a. Common mortgage refinance fees ; Origination fee, Up to % of loan amount ; Credit report fee, $10 to $ per applicant ; Document preparation fee, $50 to $ payment be? Tell us about what mortgage you're looking for and we'll estimate how much your monthly payments will be. Step 1. What are you looking to do? Calculate what your mortgage payment could be. Find out how changing your payment frequency and making prepayments can save you money. How much of a down payment do you need? To get the best mortgage interest rates and terms, you'll want a down payment amounting to 20% of a home's sale price. Our Mortgage payment calculator can help determine your monthly payment and options to save more on mortgages. Visit Scotiabank online tool today!

A mortgage payment is calculated using principal, interest, taxes, and insurance. If you want to find out how much your monthly payment will be there are. Mortgage Loan Type? Choose the How Do I Get a Mortgage? What Kind of Mortgage Should I Get? How Do I Get a Good Interest Rate? What Are Closing Costs? Interest rates vary depending on the type of mortgage refinance you choose. See the differences and how they can impact your monthly payment. To determine how much you can afford using this rule, multiply your monthly gross income by 28%. For example, if you make $10, every month, multiply $10, Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Refinance savings calculator. Enter your current monthly payment and see how it compares to what you would pay if you refinance at today's rates. Use this. Additional homeownership costs (optional). Expand Close. The cost of home ownership is more than a mortgage payment. Estimate additional potential costs. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. What is the cost of the property you would like to buy? Invalid value Make an appointment with an advisor to discuss your project, no matter how far along you. How do you calculate monthly mortgage payments · Determine your principal. · Calculate your monthly interest rate by dividing the annual interest rate by How a Larger Down Payment Impacts Mortgage Payments* ; 15%, $30,, $,, $ ; 10%, $20,, $,, $ The loan amount, the interest rate, and the term of the mortgage have a dramatic effect on the total amount you will pay for your home. For example, a fixed loan for $, with a year mortgage would result in monthly payments of $ ($, / 30 /12 = $). Interest. This is the. What's included in a mortgage payment? Your mortgage payment consists of four costs, which loan officers refer to as 'PITI.' These four parts are principal. National mortgage rates by loan term ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed rate. %. % ; year. To determine the monthly rate, divide the annual amount by So, if your rate is 6%, the monthly rate would be /12 = How to Calculate. The amount you expect to borrow from your financial institution. · Annual interest rate for this mortgage. · The number of years and months over which you will. Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. Closing costs are typically about % of your loan amount and are. Top home mortgage FAQs. How does my credit rating affect my home loan interest rate? Do I need to get a home appraisal in order to get a home. To save money, your best rate and mortgage payment go hand-in-hand. Here's how our mortgage payment calculator works: Purchase Price defaults to an average home.

What Is The New Irs Standard Deduction

Standard Deduction The Tax Cuts and Jobs Act (TCJA) increased the standard deduction from $ to $ for individual filers, from $ to $ for. What's New. Coronavirus-related lump-sum payments attributable to prior years, Social security benefits. Standard deduction, Standard Deduction. The standard deduction in is $14, for individuals, $29, for joint filers, and $21, for heads of households. The IRS adjusts the standard deduction. If one of you takes a standard deduction, you both must take a standard deduction. IRS: Earned Income Tax Credit · Free File -- Electronically File Your. The IRS issues a revenue procedure containing inflation-adjusted standard deductions for the following tax year. Below are the inflation-adjusted standard. Looking to the new year, the IRS standard deduction for seniors is $13, for those filing single or married filing separately, $27, for qualifying. The loss of personal exemptions offset some of the gain from higher standard deductions, but the net result was an increase in the taxable income threshold in. How Much Is My Standard Deduction? Topic No. , Standard Deduction · Subscribe to IRS Tax Tips. Page Last Reviewed or Updated: Jan Caution: Using the "Back" button within the ITA tool could cause an application error. Begin. Page Last Reviewed or Updated: Jan Standard Deduction The Tax Cuts and Jobs Act (TCJA) increased the standard deduction from $ to $ for individual filers, from $ to $ for. What's New. Coronavirus-related lump-sum payments attributable to prior years, Social security benefits. Standard deduction, Standard Deduction. The standard deduction in is $14, for individuals, $29, for joint filers, and $21, for heads of households. The IRS adjusts the standard deduction. If one of you takes a standard deduction, you both must take a standard deduction. IRS: Earned Income Tax Credit · Free File -- Electronically File Your. The IRS issues a revenue procedure containing inflation-adjusted standard deductions for the following tax year. Below are the inflation-adjusted standard. Looking to the new year, the IRS standard deduction for seniors is $13, for those filing single or married filing separately, $27, for qualifying. The loss of personal exemptions offset some of the gain from higher standard deductions, but the net result was an increase in the taxable income threshold in. How Much Is My Standard Deduction? Topic No. , Standard Deduction · Subscribe to IRS Tax Tips. Page Last Reviewed or Updated: Jan Caution: Using the "Back" button within the ITA tool could cause an application error. Begin. Page Last Reviewed or Updated: Jan

What are standard deductions? · $12, for single or married filing separate filers · $19, for head of household filers · $25, for married filing jointly. For single taxpayers, the standard deduction rose to $14,, a $ increase from the previous year. Heads of households, or unmarried taxpayers who have. Annually · IDR Issues New Income Withholding Tax Tables for – December 13, any amount of itemized or standard deduction from federal form , line. The standard deduction amounts for are: $27, – Married Filing Jointly or Qualifying Surviving Spouse (increase of $1,). Other deduction questions · Back to Frequently Asked Questions. Page Last Reviewed or Updated: Aug Share · Facebook · Twitter · Linkedin. Print. Footer. The standard deduction in is $14, for individuals, $29, for joint filers, and $21, for heads of households. The IRS adjusts the standard deduction. The Pennsylvania personal income tax does not provide for a standard deduction or personal exemption. However, individuals may reduce tax liabilities. Deductions (other than the standard deduction). Any additional amounts you want to withhold from each check. New Job. When you start a new job, you must fill. Standard Deduction The Tax Cuts and Jobs Act (TCJA) increased the standard deduction from $ to $ for individual filers, from $ to $ for. income is $63, ($50, + $13, standard deduction). Using the A new job or extra income can change your tax bracket. We can help you. Looking to the new year, the IRS standard deduction for seniors is $13, for those filing single or married filing separately, $27, for qualifying. Other deduction questions · Back to Frequently Asked Questions. Page Last Reviewed or Updated: Aug Share · Facebook · Twitter · Linkedin. Print. Footer. Tax Year Standard Tax Deduction Amounts · If you are age 65 or older, your standard deduction increases by $1, if you file as single or head of household. On a federal level, the IRS allows the taxpayer to deduct $12, from this, meaning only $7, of the total income is subject to income taxes which puts the. taxpayers that itemize deductions, not those who take the standard deduction. The deduction is based on adjusted gross income and number of exemptions claimed. Limitation on deduction for state and local tax - Federal tax reform limited the amount you can deduct for state and local taxes. You cannot claim more than. We have a lower standard deduction than the IRS. Do you What went wrong? Last updated: 12/22/ Help. Find your answer online · Wait times · Chat. The standard deduction is increased to $27, for married individuals filing a joint return; $20, for head-of-household filers; and $13, for all. Under United States tax law, the standard deduction is a dollar amount that non-itemizers may subtract from their income before income tax is applied. Missouri's standard deduction is equal to the federal standard deduction. New Income Tax Deductions. Missouri Farmland Sold to a Beginning Farmer.

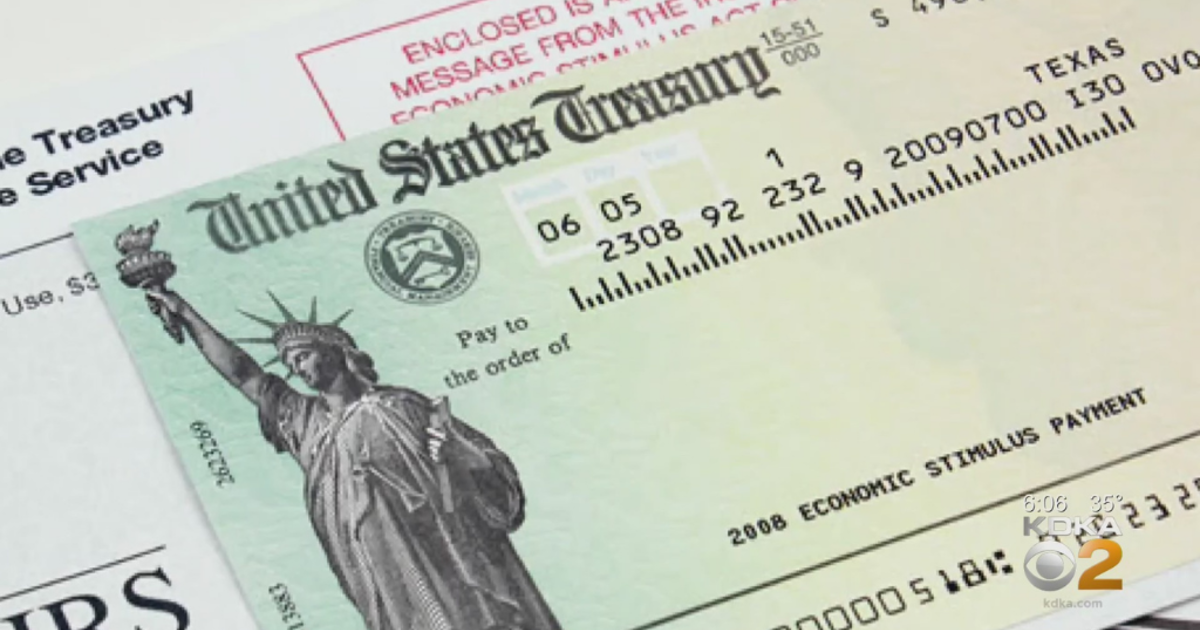

How Can I Check For My Stimulus Check

Use the IRS Get My Payment tool to track stimulus money. For the third stimulus check, it's worth visiting the IRS' online portal designed to track the status. If I owe child support, will my tax return be applied to my child support arrears? Maybe. Federal law and regulations determine when federal payments are. To check the status of your Economic Impact Payment, please visit the IRS Get my Payment page; To check if you qualify for the Economic Impact Payment. They should be prepared to provide their social security number, zip code and filing status reported on their returns when inquiring on their refunds. Checking. Looking for your surplus tax refund? Most refund checks have already been issued, but it is never too late to check Check my Refund Status · Register a. How will I receive my rebate? You can expect to receive your rebate based on how you received your tax year refund, by direct deposit or paper check. If. You can start a payment trace by calling the IRS at Or mail or fax a completed Form , Taxpayer Statement Regarding Refund, to the IRS. The IRS also launched a new hotline to help answer FAQs about stimulus payments, which you can reach at How do I get the Third Economic Impact. Issue information for US Treasury checks can be verified provided that the financial institution has a valid routing transit number, check number and check. Use the IRS Get My Payment tool to track stimulus money. For the third stimulus check, it's worth visiting the IRS' online portal designed to track the status. If I owe child support, will my tax return be applied to my child support arrears? Maybe. Federal law and regulations determine when federal payments are. To check the status of your Economic Impact Payment, please visit the IRS Get my Payment page; To check if you qualify for the Economic Impact Payment. They should be prepared to provide their social security number, zip code and filing status reported on their returns when inquiring on their refunds. Checking. Looking for your surplus tax refund? Most refund checks have already been issued, but it is never too late to check Check my Refund Status · Register a. How will I receive my rebate? You can expect to receive your rebate based on how you received your tax year refund, by direct deposit or paper check. If. You can start a payment trace by calling the IRS at Or mail or fax a completed Form , Taxpayer Statement Regarding Refund, to the IRS. The IRS also launched a new hotline to help answer FAQs about stimulus payments, which you can reach at How do I get the Third Economic Impact. Issue information for US Treasury checks can be verified provided that the financial institution has a valid routing transit number, check number and check.

check the status of your current year refund. I have lost or misplaced my refund check, how do I go about getting a new one? For a replacement check you. It's easy to check on your tax refund. All you need is your Social Security number and refund amount for tax year Use the Check the Status of Your Refund. Learn how to check the status of your tax refund, request a direct deposit of your individual income tax refund, or contact DOR customer service. It's easy to check on your tax refund. All you need is your Social Security number and refund amount for tax year Use the Check the Status of Your Refund. Refer to the IRS notices that were mailed to you. · Check your bank statements. · Request an account transcript. · Create an account on itimas.online · To create. You can visit the IRS website for more information about Economic Impact Payments. You can check the status of your payment here. Disclaimer: Information. The IRS will use your most recently filed taxes to determine where to send your stimulus money and the amount you are eligible to receive. Use the Georgia Tax Center's "Check my Refund Status" tool to track the status of your Georgia Tax Refund. Duties of the Office; Event Requests; Contact. Taxes Subnavigation toggle for Taxes. All Tax Forms · Check my Refund Status · Register a New Business · Refunds. Use the IRS "Get My Payment" tool to check on the status of your Economic Impact Payment. It will let you know when the IRS is depositing your payment or. The IRS's Get My Payment application is the only official way to find out when you're scheduled to receive your stimulus payment. In fact, the IRS has asked. If you do not know which agency authorized the payment, call the Bureau of the Fiscal Service Call Center at They can help you determine which. Look it up on on the IRS website. They should be able to tell you when it is supposed to be deposited to your account. If you don't have direct. The IRS will use your most recently filed taxes to determine where to send your stimulus money and the amount you are eligible to receive. They should be prepared to provide their social security number, zip code and filing status reported on their returns when inquiring on their refunds. Checking. Check your refund status. Use our Where's my Refund tool or call for our automated refund system. Both options are available 24 hours a day. If you don't make enough income to have to file taxes, you may miss out on the federal STIMULUS check, also known as the Economic Impact Payment. Keep a copy of the tax return available when checking on the refund status online or by telephone. Refer to the processing times below to determine when you. the option of talking to a representative. Those with questions can call the stimulus check hotline at IRS Get My Payment Tool. Get your. If I owe child support, will my tax return be applied to my child support arrears? Maybe. Federal law and regulations determine when federal payments are.

1 Year Personal Loan

Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! Borrow up to $1 million with a secured or unsecured personal loan or line of credit.1,2. handshake-icon-pbb. A Dedicated Relationship Manager. Best Personal Loans From Top Lenders in August Rates starting at % APR and amounts up to $50, Checking rates won't affect your credit score. Repay a personal loan in terms of months and with fixed rates ranging from % to % APR (rates as of ). Repayment Example: An American. Personal loans can be used for a variety of reasons such as consolidating higher interest loans, home improvements, consolidating credit card debt, paying for. Interest Rate1. Term. 1 year (12 months), 2 years (24 months), 3 years (36 months), 4 years (48 months), 5 years (60 months), 6 years (72 months). Term. 1 year. Learn about TD Bank Fit Loans, fixed rate unsecured personal loans from $ - $, no application or origination fees, & terms up to 60 months. Personal loans are loans with fixed amounts, interest rates, and monthly payback amounts over defined periods of time. Typical personal loans range from $5, If you aren't a current U.S. Bank customer, a personal loan could give you quick access to funds for your one-time financing needs up to $25, We consider. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! Borrow up to $1 million with a secured or unsecured personal loan or line of credit.1,2. handshake-icon-pbb. A Dedicated Relationship Manager. Best Personal Loans From Top Lenders in August Rates starting at % APR and amounts up to $50, Checking rates won't affect your credit score. Repay a personal loan in terms of months and with fixed rates ranging from % to % APR (rates as of ). Repayment Example: An American. Personal loans can be used for a variety of reasons such as consolidating higher interest loans, home improvements, consolidating credit card debt, paying for. Interest Rate1. Term. 1 year (12 months), 2 years (24 months), 3 years (36 months), 4 years (48 months), 5 years (60 months), 6 years (72 months). Term. 1 year. Learn about TD Bank Fit Loans, fixed rate unsecured personal loans from $ - $, no application or origination fees, & terms up to 60 months. Personal loans are loans with fixed amounts, interest rates, and monthly payback amounts over defined periods of time. Typical personal loans range from $5, If you aren't a current U.S. Bank customer, a personal loan could give you quick access to funds for your one-time financing needs up to $25, We consider.

Excellent credit and up to a three-year term are required to qualify for lowest rates. Monthly payments for a $15, loan at % with a term of three. Interest rates: % to %. Loan amounts: $2, to $35, Repayment terms: 1 to 5 years. Min. credit score: Discounts: None. Fees: Origination fee. Personal Loan · Competitive low interest rates · Flexible terms up to 60 months · No collateral required · No origination fee or prepayment penalty. PSECU personal loans can provide flexible cash. Explore PSECU personal loan rates, and use the PSECU loan calculator to estimate your PSECU loan payment. With Personal Loan rates as low as % APRFootnote 1 ; The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term. With a personal loan, interest rates and monthly payments remain fixed throughout the life of the loan. This makes it easier to plan and manage your budget. And. Example loan: four-year $20, loan with an origination fee of %, a Where permitted by applicable state law, Achieve Loans charges: 1) an. You can get a personal loan from $1, to $50,⁵. Fixed rates and terms. Choose between personal loans in 3 or 5 year terms, with fixed. Year, Initial Balance, Interest, Principal, End Balance. , $5,, $ Once you're ready to shop for a personal loan, don't just look at one source. Excellent credit and up to a three-year term are required to qualify for lowest rates. Monthly payments for a $15, loan at % with a term of three. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Rates are fixed, so your payment doesn't change. · Interest rates as low as % APR. · Up to $30, in one lump sum. · Funds are typically available the same. Call or visit a branch to apply. Call or visit (Payment example based on a 7-year certificate with a % APY.). 1 For example, a three-year $10, personal loan would have an interest rate of % and a % origination fee for an annual percentage rate (APR) of. When you are approved for a personal loan, you receive the funds in one lump sum and your interest rates are fixed for the life of the loan, resulting in a. With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher interest credit card. We offer loans from $1, Rates are fixed, so your payment doesn't change. · Interest rates as low as % APR. · Up to $30, in one lump sum. · Funds are typically available the same. 1. Why choose a personal loan from Huntington? We want to see you achieve financial success, whatever that means for you. Our loan process is fast and secure. Skip-A-Pay is an optional program to defer a consumer loan payment for a $25 fee, per skipped loan payment. Your loan must be open for one (1) year to be. Rates on personal loans vary considerably by credit score and loan term. For example, the chart above shows borrowers with fair to poor credit tend to be.